Tuesday, 24 July 2018

Time for a cartel rewards rethink?

If the ACCC wants more whistleblowers, they might have to push a lot harder for whistleblower reward legislation. I acted for a whistleblower in a major corporate corruption matter (not an ACCC matter but rather a NSW Police matter) and based on my experience there is simply no rational reason for an employee to blow the whistle on illegal conduct (unless of course they are involved in the illegal conduct up to their neck and are blowing the whistle to save their own skin!). If regulators want "clean skin" whistleblowers to come forward, the only way to encourage them is by offering a reward. Why else would a clean skin decide to blow the whistle? Not only is blowing the whistle extremely stressful, but the employer will look for any devious means of getting rid of the whistleblower, the whistleblower's colleagues won't trust and won't want to work with the whistleblower anymore and the relevant law enforcement agencies will more than likely forget about the whistleblower as soon as they have secured the whistleblower's evidence! The ACCC should follow the lead of the UK Competition and Markets Authority which is offering rewards of up to £100,000 to whistleblowers for evidence of a cartel.

https://www.smh.com.au/business/consumer-affairs/top-watchdog-seeks-out-new-whistleblowers-20180724-p4ztcx.html

Thursday, 19 July 2018

Alphabet in the soup...again!

The European Commission has fined Google €4.34 billion ($AUD6.86 billion) for illegal practices regarding Android mobile devices to strengthen dominance of Google's search engine. Sounds a bit like the Microsoft case all over again!

By the way, the EC is still to announce the sanctions it will be imposing against Google as a result of its Adsense investigation. In relation to Adsense, the EC has formed the preliminary view that Google abused its dominant position in order to prevented existing and potential competitors, including other search providers and online advertising platforms, from entering and growing in this commercially important area.

Sounds like another multi-billion euro fine for Google is just around the corner!

Labels:

abuse of dominance,

Adsense,

Alphabet,

Android,

European Commission

Tuesday, 17 July 2018

Regulatory Returns on Investment

I was reading an article in the recent edition of the AICD's Company Director Magazine. The article recorded the total civil penalties recovered by ASIC over the 2017-2018 financial year at $35.1m. I thought I'd compare that figure to the amount recovered by the ACCC over the same period - here are the results: ASIC Annual budget 2017-2018 $550m Civil penalty recoveries $35.1m ROI 6.3% ACCC Annual budget 2017-2018 $215m Civil penalty recoveries $172.5m ROI 80.2% Looks to me like the ACCC is a much better financial investment for the Government that ASIC! However, neither the ACCC or ASIC can compete with AUSTRAC after their $700 million penalty against CBA: AUSTRAC Annual budget 2017-2018 $92m CBA penalty $700m ROI 760%

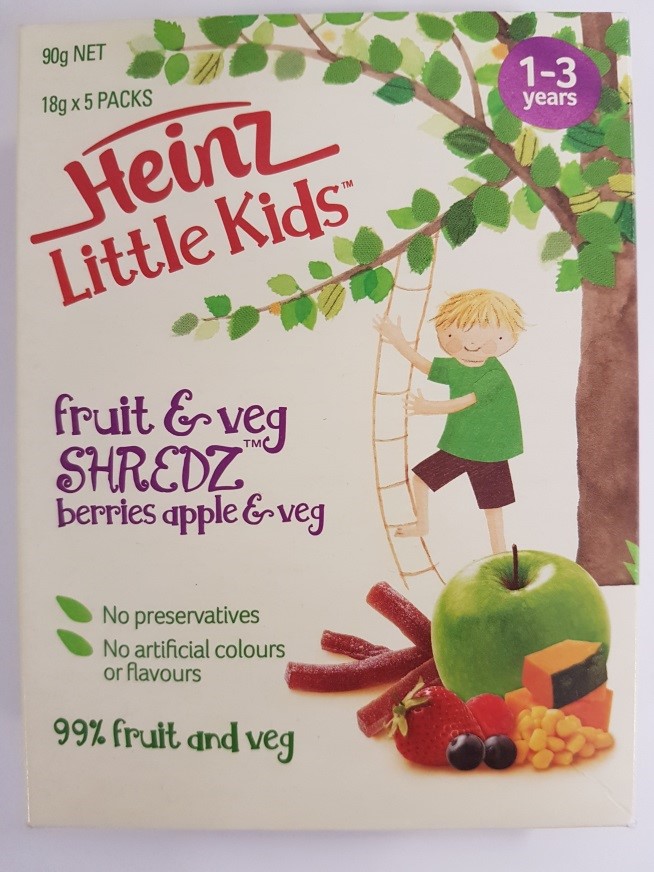

ACCC v Heinz - penalty case survives...just!

I was having a quick look at the ACCC's case against Heinz in relation to the Little Kids Shredz products. I must admit, I was left scratching my head...again! The ACCC sues Heinz for contraventions of sections 18, 29 and 33 of the ACL. However, the ACCC then fails to make any evidentiary submissions to the Court in relation to either sections 29 and 33 - see para 271.

Rather the ACCC focuses entirely on section 18 which is a non-penalty provision.

Did the ACCC forget that in order to get a penalty out of Heinz it needed to establish a contravention of either sections 29 or 33? Strangely the ACCC then goes to great lengths to try to prove that Heinz had either actual or constructive knowledge of the misrepresentations, even though knowledge is not an element of any of the contraventions. The only explanation I can see for spending so much time trying to prove knowledge is to get a bigger penalty.

However, why bother making submissions on knowledge unless you have first established a contravention of a penalty provision? Luckily for the ACCC the Judge was able to find an evidentiary basis for a contravention of section 29(1)(g) (see para 278), so the ACCC should end up getting a penalty out of Heinz!

271 Although both the ACCC’s opening and closing submissions indicated that it pursued its allegations of contraventions of ss 29(1)(a), 29(1)(g) and 33 and its closing submissions identified in an distinct way the elements of contraventions of those provisions, it did not address any submissions relating the evidence in this case to those elements or seek to show how those contraventions were established. Its position seemed to be that the contraventions would be established by the same matters indicating that Heinz’s conduct was misleading or deceptive.

278 In summary, in the absence of submissions from the ACCC, I find that it has established only contraventions of s 29(1)(g) of the ACL. I do not think that conclusion involves unfairness to Heinz as the elements of the contraventions are the same as those it knew it had to confront in relation to s 18.

http://www.judgments.fedcourt.gov.au/judgments/Judgments/fca/single/2018/2018fca0360

Servcorp cops a serve for unfair contract terms

Servcorp has consented to orders declaring a number of its contractual terms as unfair. I always like going back and having a looking at the comments the company made when it got sued by the ACCC. Here is what Servcorp said in September 2017: "SRV is disappointed that the ACCC has decided to commence legal proceedings against it,"he (Pearce) said. "SRV maintains that its serviced office agreements are negotiable contracts and do not constitute standard-form contracts regulated by the unfair contract terms regime under the Australian Consumer Law." "In its 39 years of existence, Servcorp's agreements with its clients have never been challenged by any government authority as to their fairness or legitimacy, SRV currently operates in over 60 jurisdictions globally," he said. Servcorp executive director Taine Moufarrige told Fairfax Media that Servcorp has instructed its lawyers, PWC, to defend the proceedings. I really thought (particularly after reading the above fightin' words!) that this case may go the distance, all the way to a judgment. I guess we will have to wait a little bit longer for some meaningful case law in relation to the now not so new UCT laws.

https://www.accc.gov.au/media-release/servcorp%E2%80%99s-business-contract-terms-declared-unfair

ACCC v Click Energy - sub judice cart before the horse

It seems to me that the ACCC does not get the concept of sub judice comment when it commences legal proceedings. Have a look at the recent media release re the Click Energy case filed yesterday.

The title to the media release is "ACCC takes action against Click Energy for misleading savings claims" Note that the ACCC has left out the word "alleged" in the title to the media release. In other words, Click is not facing an "allegation" but rather has been found, at least by the ACCC, to have engaged in misleading conduct. Then there is this comment in the body of the media release - “We believe that Click Energy’s conduct is among the worst practices we see in retail electricity marketing". Therefore, not only has the ACCC declared that Click has engaged in misleading conduct but their conduct is amongst the worst misleading conduct that the ACCC has ever seen in retail electricity marketing. It is just a matter of time before a judge gets very annoyed about the statements which the ACCC is making in its media releases on the commencement of legal proceedings.

https://www.accc.gov.au/media-release/accc-takes-action-against-click-energy-for-misleading-savings-claims

ACCC v Cascade - another one bites the dust

Looks like the ACCC has gone down again - this time in relation to their case against the Obeids for the alleged Mount Penny cartel. Seems to me the ACCC has been losing many of their big cases over the last few years : 1 Cussons - alleged cartel 2 Pfizer - alleged misuse of market power 3 Woolworths - alleged unconscionable conduct (Mind the Gap) 4 Medibank Private - alleged misleading and deceptive 5 Egg Corporation - alleged attempted price fixing 6 Electrical Contractors - alleged cartel 7 ANZ - alleged price fixing The question is whether the ACCC is losing because it is pushing the boundaries of the law and thus taking bigger risks or rather whether its investigation and litigation skills are not up to the job. Unfortunately, from my understanding of the above cases, I'd have to lean towards the latter explanation for the losses. It seems to me that many ACCC cases are misconceived and poorly prepared. Eg the ACCC must always cross examine the other sides' expert witness at trial, witnesses have to be locked in to give evidence prior to the ACCC instituting proceedings, don't run unconscionable conduct cases on the documents and is an attempt to induce a cartel really worth the time and effort to litigate. I could go on!

https://lawyerly.com.au/accc-loses-coal-tender-cartel-case-obeid-son-wins-suppression-order/

SME Committee Annual Conference - 26 October 2018

The SME Committee of the Law Council of Australia is holding its annual conference in Melbourne this year on Friday, 26 October 2018.

We have an excellent lineup of top quality speakers, including:

* Judy O'Connell, Victoria Small Business Commissioner; * Kate Carnell AO, ASBFE Ombudsman; * Mick Keogh, ACCC Deputy Chair and Small Business Commissioner and * Peter Strong, COSBOA CEO. So, if you want to hear from speakers who genuinely "get" small business, make sure you come along.

https://www.lawcouncil.asn.au/event/sme-conference-2018

ACL penalties to go up, up and away...but not quite yet

Looks like the Bill to increase the pecuniary penalties under the Australian Consumer Law to $10m, three times the benefit gained or 10% of annual turnover has been held up in the Senate.

The new law was supposed to commence on 1 July 2018.

Australian businesses will be thankful for a reprieve until mid August when the Senate will be back in session.

https://www.aph.gov.au/Parliamentary_Business/Bills_Legislation/Bills_Search_Results/Result?bId=r6053

ACCC v Mitolo - more "egregious" sub judice commentary

ACCC has taken legal action against Mitolo, the largest potato wholesaler in Australia, for alleged unfair contract terms and breaches of the Horticulture Code.

Unfortunately,, the ACCC has again decided to make some "egregious" sub judice commentary about the case in its media release:

“These are some of the most egregious terms we have seen in agricultural contracts, and are key examples of the contracting practices in the sector that we want to address..."

“We believe that these terms have caused, or could cause, significant detriment to farmers, by passing a heavy burden of risk down to farmers, the most vulnerable player in the supply chain."

Will the ACCC never learn!

https://www.accc.gov.au/media-release/action-against-mitolo-for-alleged-unfair-contract-terms

https://www.accc.gov.au/media-release/action-against-mitolo-for-alleged-unfair-contract-terms

ACCC v Cussons - free pass for expert economist

I was having a closer look at Justice Wigney's decision in the ACCC's unsuccessful case against Cussons for alleged cartel conduct. I was very surprised to read (at para 400) that the ACCC chose not to cross examine Cussons' expert economist Professor George Hay.

I've never heard of the ACCC ever giving the other side's expert, let alone their economic expert, a free pass on cross examination!

- Professor Hay’s opinion, in summary, was that it was likely that the Suppliers would have transitioned to ultra concentrates at the same time in early 2009 without any collusive arrangement or understanding. That was so for a number of reasons, including: that there was no economic incentive for an individual supplier to delay the introduction of ultra concentrates and forgo the economic benefits of reduced costs and possibly higher margins which were known to exist by 2008; the retailers’ strong economic reasons for requiring a prompt and simultaneous transition by all suppliers; and the retailers’ structured range review processes. Professor Hay was not cross-examined and his opinions were not tested or challenged.

- The Commission submitted, in effect, that the Court should prefer the opinions of Professor Williams. It expressly or implicitly criticised aspects of Professor Hay’s analysis and his opinions. In those circumstances it was somewhat unusual, if not unhelpful, that the Commission elected not to cross-examine Professor Hay. Be that as it may, the Commission’s efforts to persuade the Court to prefer Professor Williams’ opinions were unsuccessful. That was not simply a product of the fact that Professor Hay was not cross-examined. Ultimately, upon careful consideration of the respective reports, and taking into account Professor Williams’ oral evidence, and the evidence as a whole, the opinions of Professor Hay were found to be of more probative value and assistance than those of Professor Williams. Professor Hay’s evidence and his opinions were, on the whole, more persuasive than Professor Williams’. That is so for a number of reasons.

Apple loose change

Apple has agreed to pay $9 million in penalties for making false or misleading representations to customers with faulty iPhones and iPads about their rights under the Australian Consumer Law

By my reckoning that means Apple has only $199,991,000,000 cash left in the bank!

Oops, forgot to convert the penalty into US dollars. Should be a $US6.7 million penalty, leaving only $199,993,300,000 left in Apple's bank account.https://www.accc.gov.au/media-release/iphone-and-ipad-misrepresentations-cost-apple-inc-9-million-in-penalties

Interesting observation by Justice Lee about the ACCC's $9m penalty against Apple. He is spot on describing the penalty as "loose change". I particularly liked how Justice Lee pointedly asked counsel for the ACCC how many minutes it would take the “behemoth” to recoup the $AUD9 million. By my calculations and based on Apple's annual sales to September 2017 of $AUS308 billion, the answer is 15 minutes and 21 seconds! You have to wonder why the ACCC didn't hold out for more money given they had up to 275 separate contraventions each worth $10 m each - maybe someone at the ACCC forgot to put a zero in their penalty submissions!

https://www.brisbanetimes.com.au/business/consumer-affairs/loose-change-judge-suggests-apple-could-recoup-9m-penalty-in-minutes-20180719-p4zset.html

ACCC always get their man!

ACCC has had a win against Domain Name Corp and Domain Name Agency in relation to blowing - ie sending unsolicited renewal notices.

However, the most interesting aspect of the case is arguably the following order made earlier in the proceedings by Justice McKerracher in relation to Steven Bell, the third respondent and owner of the businesses:

Pursuant to Rule 30.33 of the Federal Court Rules 2011 (Cth), the Third Respondent (Steven Bell), a prisoner detained in custody at Hakea Prison, be produced to the Federal Court of Australia in order to attend and participate in mediation in this proceeding on Thursday 21 December 2017 at 10.00 am at Level 4, Commonwealth Law Courts Building, 1 Victoria Avenue, Perth, Western Australia.

It just shows the lengths the ACCC will go to get their man.

https://www.accc.gov.au/media-release/domain-name-corp-and-domain-name-agency-to-pay-195-million-in-penalties

https://www.accc.gov.au/media-release/domain-name-corp-and-domain-name-agency-to-pay-195-million-in-penalties

Austrac v CBA - opportunity lost

Austrac's $700 million fine against CBA in the money laundering case may sound impressive but in reality it's an opportunity lost. Austrac should have hung in there for a $1 billion plus penalty. After all, CBA failed to report 53,500 illegal transactions through its IDMs (Immediate Deposit Machines) of $10,000 or more, totalling $625 million, plus a further $77 million of suspicious transactions.

In other words, CBA is paying approximately $13,000 per breach in relation to conduct which is subject to a maximum penalty of $21 million per breach. By my calculations that means the fine is actually only 0.06% of the maximum fine which could have been imposed.

I also reckon Tabcorp must be feeling a bit hard done by at the moment after agreeing to pay a fine of $45 million back in March 2017 for a "measly" 108 breaches of the same legislation, which equates to $416,000 per breach!https://www.smh.com.au/business/banking-and-finance/cba-reaches-700m-settlement-over-austrac-allegations-20180604-p4zj9p.html

Alleged Banking Cartel Case Commenced

Some major news on the ACCC front - the ACCC has foreshadowed that criminal charges are to be laid against ANZ and others in relation to an alleged cartel concerning an institutional share placement.

https://www.accc.gov.au/media-release/correction-criminal-cartel-charges-to-be-laid-against-anz

Wow! The ACCC has also foreshadowed criminal proceedings against Deutsche Bank for the alleged cartel concerning the institutional placement. The other two underwriters were Citigroup and JP Morgan so it will be interesting to see if they both get charged as well. If one of them doesn't get charged that may suggest that they were the whistleblower. Hope the ACCC has deep pockets as this case is going to be a very expensive fight for them to win!

https://www.accc.gov.au/media-release/update-criminal-cartel-charges-to-be-laid-against-deutsche-bank

Further ACCC announcement - charges are to be laid against Citigroup. Therefore, it looks like JP Morgan as the third underwriter may have been the whistleblower.

https://www.accc.gov.au/media-release/update-criminal-cartel-charges-to-be-laid-against-citigroup

A number of senior executives have also been charged as part of the ACCC's case against ANZ, Deutsche Bank and Citi Group. One thing that should be noted is how the criminal prosecution process works. It is the Commonwealth Director of Public Prosecutions (CDPP) who has to make the final decision whether to commence a criminal prosecution. The CDPP's decision also has to be made independently of the referring agency. In other words, the ACCC doesn't make the final decision on whether to commence a prosecution or who to charge. The CDPP under its Prosecution Policy has a two-stage test that must be satisfied before a prosecution is commenced: (1) there must be sufficient evidence to prosecute the case; and (2) it must be evident from the facts of the case, and all the surrounding circumstances, that the prosecution would be in the public interest. I worked with the CDPP on a couple of criminal prosecutions during my time at the ACCC and I found them to be very exacting in terms of the evidence they required before they would decide to commence a prosecution. Indeed, it seemed to me at the time that the standard was way higher than merely "sufficient evidence".

https://www.accc.gov.au/media-release/criminal-cartel-charges-laid-against-anz-citigroup-and-deutsche-bank

Labels:

ACCC enforcement,

banking,

cartels,

price fixing

ACCC v Pfizer - time to move on?

The ACCC has lost the Pfizer s46 misuse of market power appeal.

It may be time for the ACCC to drop this one given they lost at the first instance before Justice Yates and have now lost before Justices Greenwood, Foster and Middleton on appeal, who are all very smart competition law judges

https://www.accc.gov.au/media-release/accc-unsuccessful-in-appeal-against-pfizer

Subscribe to:

Comments (Atom)